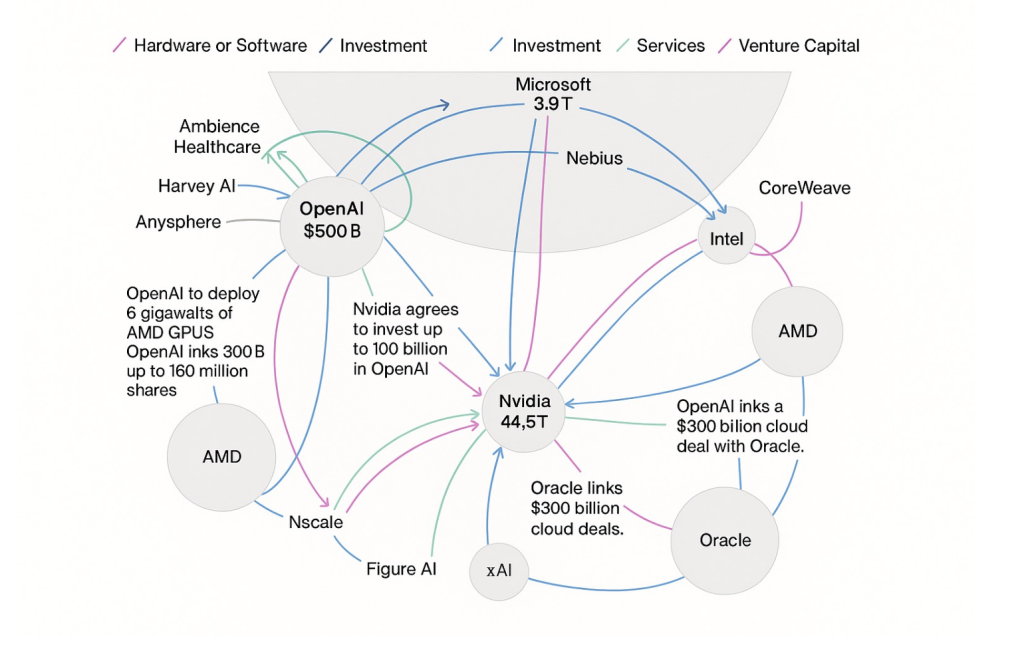

OpenAI isn’t just a chatbot company anymore — it’s the nucleus of a $500 billion AI network linking @Microsoft, NVIDIA, #Google , #Oracle, AMD, #CoreWeave , and next-gen players like Mistral AI and #grok .

A recent Bloomberg visualization maps this trillion-dollar loop of capital + compute + capability driving the AI boom:

Oracle spends billions on #nvidia chips

Nvidia commits $100 B to OpenAI

OpenAI inks $300 B in cloud deals with @Oracle

#AMD powers the GPUs behind it all

AI is no longer just software — it’s infrastructure. We’ve entered the picks-and-shovels phase of the AI revolution, where chips, power grids, and cloud contracts decide who wins.

At @FilterFundVC , we view this as the Infrastructure Era of AI Investing — the stage where enduring returns come not from the next chatbot, but from the systems that make intelligence possible.

Infrastructure: GPUs, data centers, and energy grids

Platforms: Cloud orchestration & compute access

Intelligence: Foundation-model ecosystems (#OpenAI , #MistralAI , #AnthropicAI )

Trust Layers: Responsible AI, compliance, and safety infrastructure — areas where Filter Fund actively partners with emerging leaders like #GuardrailTechnologies , defining the new enterprise trust layer

This map isn’t just a snapshot — it’s a blueprint for how AI is becoming the next macro asset class.

At Filter Fund, our thesis is simple: Capital is the new Compute.

#FilterFund #AI #VentureCapital #OpenAI #Nvidia #Microsoft #AIInvesting #Infrastructure #FutureOfWork #GenerativeAI #ResponsibleAI

Disclaimer: This is not an offer to sell or a solicitation of an offer to buy any security. Investments are only available to verified accredited investors under Rule 506(c) of Regulation D.